The Devin proposition

Traditional property development concentrates risk in a single party.

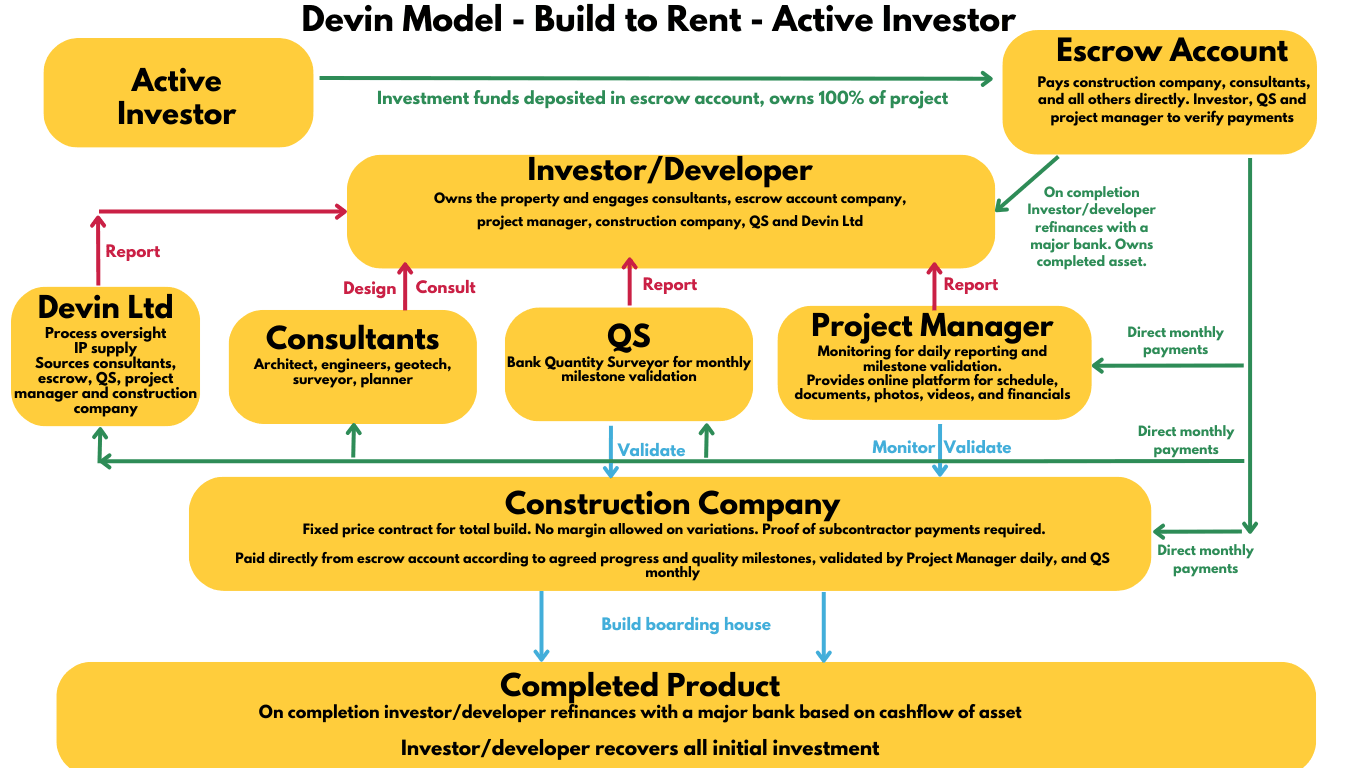

The Devin Model removes that risk entirely.

Investors benefit from:

Full capital control at all times

Independent validation of every payment

No exposure to developer insolvency or mismanagement

Refinancing on completion to recover invested capital

Ongoing ownership of a stabilised Build-to-Rent asset

This is not speculative development.

It is governed capital deployment.

How the Devin Model Works

Capital Protection from Day One

The investor supplies 100% of project funding

All funds are held in a dedicated escrow account

Funds are never controlled by a developer or builder

Payments are released only against verified milestones

Triple signatory authorisation is mandatory:

Investor

Independent Quantity Surveyor (QS)

Independent Project Manager

No single party can move capital unilaterally.

Independent Validation at Every Stage

Each phase of the project is delivered and validated independently:

Consultant Group

Design, Resource Consent, Building Consent, EPAConstruction Company

Fixed-price contract, no margin on variationsProject Manager

Daily oversight, documentation, progress verificationQuantity Surveyor

Monthly financial and construction validation

Payments are released only when all validations align.

Fixed-Price Construction with Aligned Incentives

Proven construction partners

Fixed-price contracts

No margin or management fee on variations

Proof of subcontractor payment required before drawdowns

This structure removes the incentive for cost overruns and delays.

Completion, Refinance, and Capital Return

Upon completion:

The asset is independently valued

Refinanced through a major bank

100% of the investor’s capital is reimbursed

The investor retains 100% ownership of the asset

The result:

A stabilised Build-to-Rent property

Institutional-grade governance

Ongoing cashflow

No capital remaining at risk

This is where infinite ROI is achieved.

What Devin Ltd Does (and Does Not Do)

Devin Ltd is not a developer and does not take construction risk.

Devin Ltd provides:

Ownership of the Devin Model IP

Process design and enforcement

Development management consulting during consent stages

Sourcing and coordination of independent parties

Ongoing operational governance through the iLive platform

Devin Ltd does not:

Hold investor funds

Construct buildings

Validate payments

Certify progress

This separation is deliberate and central to investor protection.

Your first step to investment

Take control of your financial future with Devin. property investment is accessible and straightforward with us guiding you through every step.